The Bank of Canada‘s January 2018 Monetary Policy Report and November 2017 Financial System Review both highlight the impact of recent government interventions on the country’s hottest housing markets – those of greater Vancouver and Toronto. In many respects, announced interventions have effectively signalled the government’s need to address the risks of inflated residential real estate valuations in Canada’s two major city centres; however, it’s now a waiting game to see what lasting effect these changes may have and whether current government actions are too little too late.

The view from the West: Vancouver’s boom

As new construction failed to keep pace with housing demand, Vancouver home prices climbed 48% between 2010 and 2016.[1] To help slow the seemingly unstoppable ascent, the government announced a 15% property transfer tax on foreign residents in July 2016, causing a minor 6 month dip in housing resales numbers, which shortly thereafter returned to their unnerving upward trend.[2] In light of resurgent demand, the government has since stepped up its game by increasing the foreign buyers’ tax to 20% in early 2018, and has now expanded the tax to other nearby cities.[3]

Let’s consider the meaning of these numbers more closely for a moment and focus on the two most commonly thrown around real estate statistics: housing resales and home price growth. Notwithstanding the fact that housing resales numbers are an illustrative measure of market supply and demand, it’s not growth in resales that has the government so afraid. The scary statistic they’re face to face with is home price growth. And failing to recognize the significance of unsubstantiated price growth – spurred on by ultra-low interest rates and heightened speculation – is fatal to the health of the real estate market as a whole.

In spite of temporary contraction in resales numbers, Vancouver was still last years’ hottest market finishing 2017 with year-over-year price growth of 14%.[4] Let’s contrast this growth rate against the S&P/TSX Composite Index’s 2017 year-over-year return of approximately 6%, not including dividends, or Canada’s CPI inflation rate of 1.6%. Even if, perhaps, the return on the Toronto stock market is not a good comparative example – we’ll leave that debate for another day – we can’t just shrug off historical market research finding that in the US, in the long run, national home price growth averages pretty close to the country’s rate of inflation.[5]

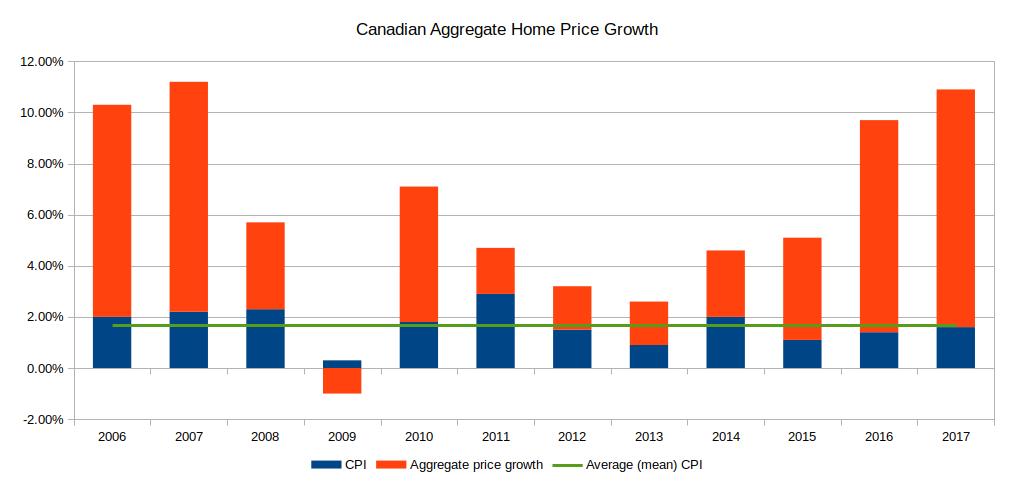

In Canada, from the period 2006 to 2017, national real home price growth averaged 6.2% while CPI came in at a measly 1.63% for the same stretch (see Graph 1, below).

Graph 1 – Canadian Aggregate Home Price Growth (2006-2017)

Now, one might attempt to dismiss the data presented in the chart above based on its short timespan; however, in spite of this shortcoming, it does paint an undeniably illustrative picture of how dramatically recent national home price growth has outpaced inflation – which explains why the government has turned justifiably fearful. And, just so we’re clear, the chart is depicting national price growth. This is not just the hot markets of Toronto and Vancouver – it’s the hot markets highly diluted by the rest.

Moving east: Anywhere but Toronto

In step with the above-normal price growth experienced in Vancouver, Toronto’s home prices ballooned 40% in the same 2010 to 2016 time frame.[6] Following the lead of it’s westerly neighbour, a 15% foreign buyers tax was proposed for the Greater Toronto Area (“GTA”) in 2017 as part of the Ontario government’s Ontario Fair Housing Plan.[7] The Ontario Fair Housing Plan announcement had a similar slowing effect on resales numbers in the GTA, causing an abrupt drop in April 2017. As in Vancouver, Toronto’s housing resales numbers have since partially rebounded from their July 2017 lows.[8] And, even with resales numbers down, Toronto managed to hit the 10% mark for year-over-year price growth in 2017.[9]

Overall, Canada’s national house price growth for 2017 came in at 10% year-over-year, highly influenced by the fact that Toronto and Vancouver make up 50% of national house sales by value.[10] And this is by no means an insignificant statistic. If Toronto and Vancouver real estate prices are found to be overvalued – or significantly overvalued – then that’s a lot of eggs in one basket.

OSFI regulations and sneaky borrowers

In a continued effort to slow climbing market valuations, the Office of the Superintendent of Financial Institutions (“OSFI”) released their own demand-side interventions consisting of new mortgage industry guidelines, which came into effect January 1, 2018. Now, a new home buyer applying for an uninsured mortgage – requiring a deposit greater than 20% – must undergo a stress test proving they can withstand moderate future interest rate increases.[11]

A similar stress test came into effect for insured borrowers – those with deposits less than 20% – in October 2016. Showing the craftiness of demand-side buyers, though this intervention initially decreased insured borrowing demand by 4.5%, it actually increased uninsured borrowing demand by a whopping 17.3% during the twelve months following its implementation – hence the need for the OSFI’s January 2018 guideline.[12]

Keeping in mind the futility of trying to stymie demand without also addressing supply, it is important to note that the new OSFI guidelines do not apply to private mortgage or non-federally regulated lenders, such as provincially regulated credit unions and mortgage investment corporations. These lenders typically lend to higher credit risk individuals and charge substantially higher interest – around 7 percentage points higher than the median mortgage rate of other lenders.[13] Furthermore, these lenders are not small fish either, with the Bank of Canada reporting that around 17% of outstanding uninsured mortgages are held by provincially regulated credit unions alone.[14]

To exacerbate the potential credit default risk in this segment of the lending market, households obtaining these high-interest mortgages are also more likely to have second mortgages and, therefore, less home equity. Furthermore, highly indebted borrowers are significantly worse off financially when interest rates increase, as their mortgage payments make up a comparatively larger per cent of their income.[15]

A summary of risks

Putting it all together, there are many disturbing indicators pointing to Canada’s housing market being worse off than even the government is willing to admit, including:

- The Bank of Canada believes that “speculative behaviour and extrapolative expectations are supporting prices” in the major markets of Vancouver and Toronto.[16]

- The proportion of new mortgages for purchases with a loan-to-value ratio of 80 per cent or less is increasing. This rise is highly concentrated in regions with strong house price growth, such as Toronto and Vancouver and their surrounding areas. Among these mortgages, a growing share have high loan amounts relative to income, as well as longer amortization periods. All else being equal, households with mortgages that have these two characteristics are more vulnerable in the event of a major adverse shock to household income.[17]

- Toronto and Vancouver make up 50% of national house sales by value – this point cannot be overstated as so much risk is centred in only two cities.

- Government interventions are slowing resales numbers, but have had little effect on price growth.

- Government interventions have been predominantly directed at the demand side of the market – although supply-side measures may be more effective – and buyers are finding ways around the demand-side measures.

- Government interventions have been directed at federal institutions who are already more likely to be prudent in their lending, while provincially regulated institutions have seen little intervention to date.

- To protect the economy, and decrease incentives for borrowing, interest rates should be gradually increased; however, there is “uncertainty around the sensitivity of the housing market to higher interest rates.”[18]

Footnotes

- Naomi Powell, “‘Prices Have No Where to Go But Up’ As Housing Supply Lags Demand in Toronto and Vancouver”, Financial Post, February 7, 2018, accessed February 7, 2018, http://business.financialpost.com/personal-finance/mortgages-real-estate/prices-have-nowhere-to-go-but-up-as-housing-supply-lags-demand-in-toronto-and-vancouver

- Joanne Lee-Young, “Impact of B.C.’s Foreign Buyer Tax Wanes as March Sales Surge Almost 50 Per Cent”, Vancouver Sun, April 18, 2017, accessed March 3, 2018, http://vancouversun.com/business/local-business/impact-of-b-c-s-foreign-buyer-tax-wanes-as-march-sales-surge-almost-50-per-cent

- CTV Vancouver Island, “Budget 2018: Foreign Buyers Tax, Speculation Tax Introduced to Victoria and Nanaimo”, CTV News Vancouver Island, February 20, 2018, accessed March 10, 2018, https://vancouverisland.ctvnews.ca/budget-2018-foreign-buyers-tax-speculation-tax-introduced-to-victoria-and-nanaimo-1.3811745

- Bank of Canada, Financial System Review, November 2017 (Ottawa: Bank of Canada, 2017), 9.

- Al, “100 Years of Inflation-Adjusted Housing Price History”, Observations, July 23, 2011, accessed March 10, 2018, https://observationsandnotes.blogspot.com/2011/07/housing-prices-inflation-since-1900.html

- Naomi Powell, “‘Prices Have No Where to Go But Up’ As Housing Supply Lags Demand in Toronto and Vancouver”, Financial Post, February 7, 2018, accessed February 7, 2018, http://business.financialpost.com/personal-finance/mortgages-real-estate/prices-have-nowhere-to-go-but-up-as-housing-supply-lags-demand-in-toronto-and-vancouver

- Ontario Ministry of Finance, “Ontario’s Fair Housing Plan”, Ontario.ca, April 20, 2017, accessed March 10, 2018, https://news.ontario.ca/mof/en/2017/04/ontarios-fair-housing-plan.html

- Katia Dmitrieva, “Sharp Rebound in Toronto Home Sales Signals Market May Have Hit Bottom”, Financial Post, November 2, 2017, accessed March 10, 2018, http://business.financialpost.com/real-estate/toronto-home-sales-fall-year-on-year-prices-down-15-1-pct-from-peak

- Bank of Canada, Financial System Review, November 2017 (Ottawa: Bank of Canada, 2017), 10.

- Ibid., 9.

- Pete Evans, “OSFI Sets New Mortgage Rules, Including Stress Test for Uninsured Borrowers”, CBC News, October 17, 2017, accessed March 10, 2018, http://www.cbc.ca/news/business/osfi-mortgage-rules-1.4358048

- Ibid.

- Bank of Canada, Financial System Review, November 2017 (Ottawa: Bank of Canada, 2017), 8.

- Ibid., 7.

- Ibid., 9.

- Ibid., 12.

- Ibid., 21.

- Ibid., 12.